Attention CFP® Professionals, RIAs & Fiduciary Wealth Advisors

Unlock Private Market Opportunities: The Advisor's Playbook for Due Diligence & Suitability

In just 90 minutes, gain the confidence to assess alternative investments like a pro and protect both your clients’ security and your credibility + earn 1.5 hours of CFP continuing education credit.

Next Webinar Session: December 18th, 10 AM - Noon CST

° Certified Financial Planners who attend will earn 1.5 hours of CE credit. However, you don’t need to be a CFP to benefit—the course is valuable for anyone interested in learning more about due diligence and alternative investments.

Do you find it hard to recommend the right private real estate investments for your clients?

This training is for financial professionals who want a proven system to evaluate alternative investments and avoid missing the right deals for their clients.

CFP® professionals and RIAs looking to add vetted private real estate opportunities to client portfolios.

Advisors needing a faster, repeatable due diligence process.

Professionals wanting real world insights from a $150M fund manager while earning 1.5 CE credits.

Without the right due diligence process, it’s easy to overlook risks, waste time on scattered research, or miss out on investing the last 10–15% of your client’s portfolio into high-quality deals.

This class gives you a step-by-step framework to evaluate private investments, so you can:

Spot sponsor red flags in minutes, not weeks.

Explain risk vs reward clearly to clients, keeping their trust and your credibility intact.

Find high-quality opportunities that meet fiduciary standards.

By mastering asset due diligence, you’ll not only diversify your clients' portfolios but also grow your reputation as a trusted advisor who makes smart, informed decisions.

Attention CFP® Professionals, RIAs & Fiduciary Wealth Advisors

Unlock Private Market Opportunities: The Advisor's Playbook for Due Diligence & Suitability

In just two hours, gain the confidence to assess alternative investments like a pro and protect both your clients’ security and your credibility + earn 1.5 hours of CFP® continuing education credit.

Attention CFP® Professionals, RIAs & Fiduciary Wealth Advisors

Unlock Private Market Opportunities: The Advisor's Playbook for Due Diligence & Suitability

In just two hours, gain the confidence to assess alternative investments like a pro and protect both your clients’ security and your credibility + earn 1.5 hours of CFP® continuing education credit.

Next Webinar Session: December 18th, 10 AM - Noon CST

° Certified Financial Planners who attend will earn 1.5 hours of CE credit. However, you don’t need to be a CFP to benefit—the course is valuable for anyone interested in learning more about due diligence and alternative investments.

What others are saying

“The interactive aspect was wonderful, and the material was holistic and very informative.”

— D.P., Wealth Advisor

“I enjoyed the case study and will be using the provided checklist with clients.”

— P.M., CFP®

“Well-put-together and comprehensive, exactly what I needed.”

— B.B., Family-Office Analyst

Do you find it hard to recommend the right private (alternative) investments for your clients?

This training is for investment advisors who want a framework to evaluate alternative investments and avoid missing the right deals for their clients.

CFP® professionals and RIAs looking to add private/alternative opportunities to client portfolios.

Advisors needing a faster, repeatable due diligence process.

Professionals wanting real world insights from a $150M fund manager while earning

CFP® 1.5 CE credits.

Without the right due diligence process, it’s easy to overlook risks, waste time on scattered research, or miss out on investing the last 10–15% of your client’s portfolio into high-quality deals.

This class gives you a step-by-step framework to evaluate private investments, so you can:

Spot sponsor red flags.

Explain risk vs reward clearly to clients, keeping their trust and your credibility intact.

Find high-quality opportunities that meet fiduciary standards.

By mastering asset due diligence, you’ll not only diversify your clients' portfolios but also grow your reputation as a trusted advisor who makes smart, informed decisions.

In this free CFP® CE class you will:

Learn the due diligence checklist recommended by Ian Colville’s $150M+ team, adaptable to any private or alternative offering.

Master the step-by-step PPM review to uncover fee nuances, structure issues, and governance factors before they affect your clients.

Understand how to assess market conditions and sponsor reliability, separating disciplined operators from wishful thinkers.

Get templates and talking points to clearly explain risk-to-reward trade-offs to clients.

Earn 1.5 CFP CE Credits

Get a behind-the-scenes look at the checklist, stress tests, and risk indicators used by a $150M AUM fund manager before committing capital to any deal.

Meet Your Instructor

Join Ian Colville, Founder & CEO of Carpathian Capital, and learn his proven due diligence approach.

With over $150M in AUM across lending and development funds, Ian’s framework helps advisors avoid mistakes, build client trust, and recommend high-return investments.

Our process is battle-tested through rising rates, supply chain issues, and market cycles. It’s how we protect investor capital while still generating double‑digit IRRs through it all.

-Ian

Meet Your Instructor

Ian Colville, CFA — Founder & CEO, Carpathian Capital

Our process is battle-tested through rising rates, supply chain issues, and market cycles. It’s how we protect investor capital while still generating double‑digit IRRs through it all.

-Ian

• Raised $150 M+ across three funds

• Delivered 12.2% net IRR since 2012

• Featured on the Inc. 5000 list (2022)

CCM's Team Experience

$1.5B

Assets Managed

15,000

Units Closed

$400M+

Equity Investment

$500M+

Construction Lending

Inc. 5000

Fastest-Growing

Why You Need This Now

The world of alternative investments can feel overwhelming, especially when you're already stretched thin by client needs and admin tasks.

Time is your most valuable resource.

Every hour spent without the right tools to evaluate investments is an hour spent not building stronger portfolios for your clients.

And without a clear framework, you risk making decisions that could harm both client relationships and your career.

This class solves that problem.

It gives you the tools to confidently assess private investments, helping you stand out as a trusted advisor who consistently adds value.

It's not just another CE course – it's the key to simplifying your process, building confidence, and helping your clients make smarter, more reliable investment choices.

What To Do Next?

Click the "Register Now" button below to sign up and secure your spot. After registering, you'll receive a confirmation email with all the details you need to join the class.

By signing up, you'll also receive educational emails about the class, reminders, and more information about Carpathian Capital.

These emails will guide you through how to invest client portfolios with our fund before the course starts. As it is in our best interest to collaborate with you.

Please note, the live training is an educational course, not a sales pitch.

This class is completely free - no strings attached. If you don’t find the content valuable, you can walk away with zero obligation, no hassle.

Our Impact in Action

Existing Joint Ventures

Get to Know Ian

Read transcript

When I established Carpathian Capital Management in 2012, I drew from lessons I had learned early in my career in consulting, investment banking and finance. I saw firsthand how, in times of crisis, people could find opportunities, meet market demands, and create lasting value.

I recognized such an opportunity as America began to recover from the 2008 financial crisis. After careful analysis, I chose to focus on residential real estate.

At Carpathian Capital, we create opportunities for investors, clients, and employees alike. We give investors access to exclusive real estate investments that are typically out of reach. We invest with best-in-class developers and homebuilders, helping them bring much-needed housing to America. For our employees, we provide meaningful projects to work on, with the freedom to innovate and grow.

What sets us apart is our personal approach. We operate with professionalism and an entrepreneurial spirit, free from corporate red tape, which allows us to be flexible, creative, and solution-oriented. We build strong relationships with our investors through direct communication and a hands-on approach to investment management.

I’ve personally built close relationships with nearly all our investors over the last 12 years, ensuring trust and open communication—key factors in our success, with most becoming repeat investors over many years.

As the housing shortage continues, we’ve leaned in by launching our unique third Development Fund, bringing together investors, developers, and homebuilders to create homes in high-growth areas while targeting attractive risk-adjusted returns. We believe that addressing the housing shortage offers both an investment opportunity and a way to build stronger communities.

My team and I look forward to discussing how our residential development strategy could contribute to building wealth as part of your investment portfolio.

Why learn from Ian?

Leads an experienced team

Proven track-record

Community-focused projects

Why You Need This Now

• The world of alternative investments can feel overwhelming, especially when you're already stretched thin by client needs and admin tasks.

• Time is your most valuable resource. Every hour spent without the right tools to evaluate investments is an hour spent not building stronger portfolios for your clients.

• Without a clear framework, you risk making decisions that could harm both client relationships and your career. This class solves that problem.

• This gives you the tools to confidently assess private investments, helping you stand out as a trusted advisor who consistently adds value.

• It's not just another CE course, it's the key to simplifying your process, building confidence, and helping your clients make smarter, more reliable investment choices.

What To Do Next?

Click the "Register Now" button below to sign up and secure your spot. After registering, you'll receive a confirmation email with all the details you need to join the class.

By signing up, you'll also receive educational emails about the class, reminders, and more information about Carpathian Capital.

These emails will guide you through how to invest client portfolios with our fund before the course starts. As it is in our best interest to collaborate with you.

Please note, the live training is an educational course, not a sales pitch.

This class is completely free - no strings attached. If you don’t find the content valuable, you can walk away with zero obligation, no hassle.

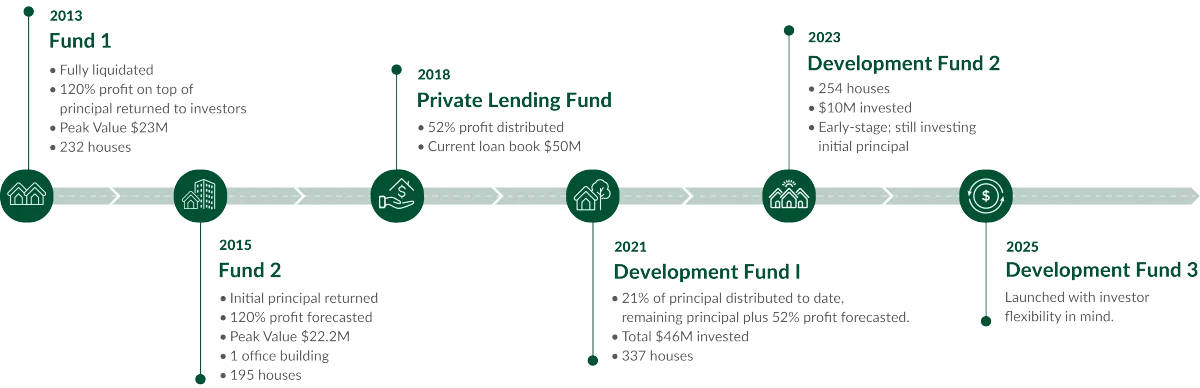

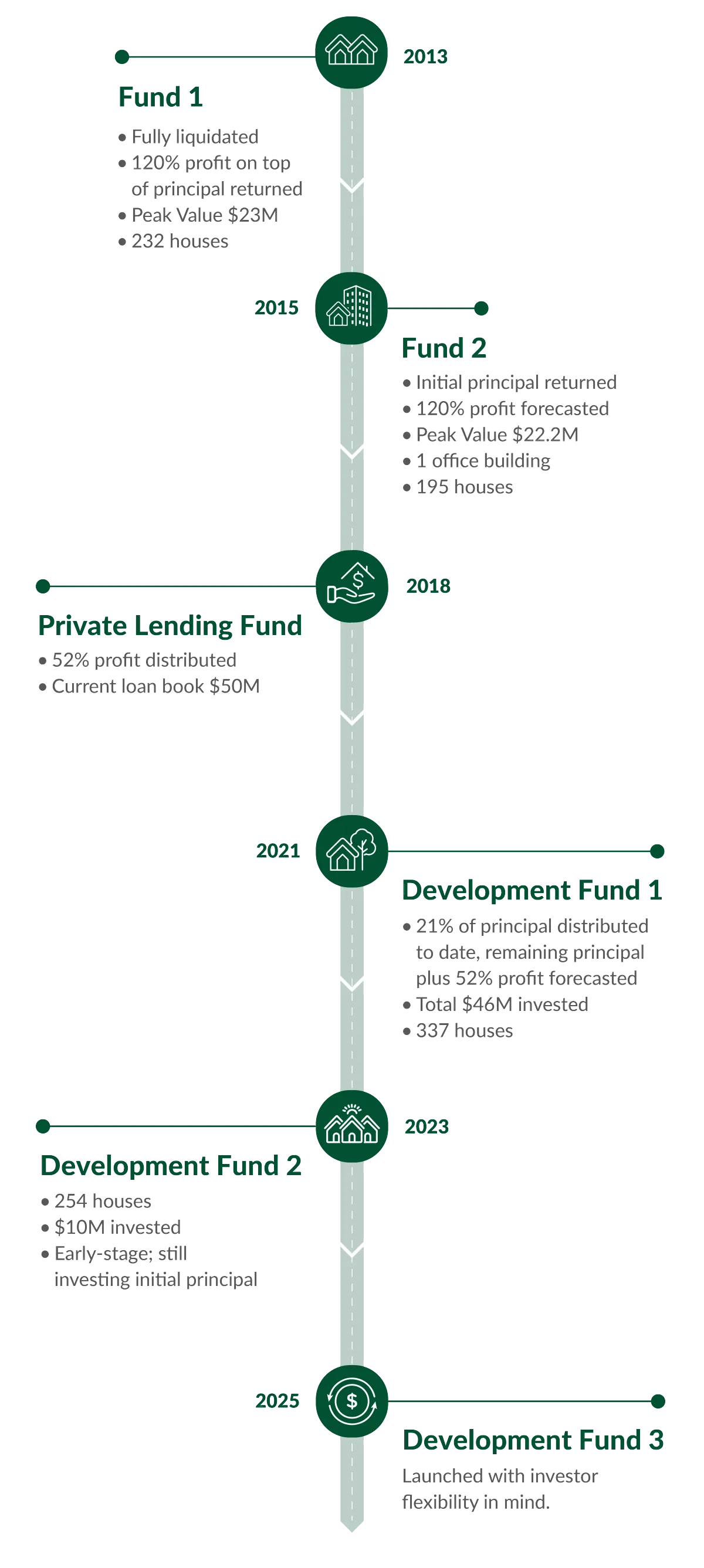

Our Journey As Carpathian Capital

Why should you learn from us?

Proven Expertise

Decades of experience in real estate, banking, and asset management.

Rigorous Due Diligence

Our thorough vetting minimizes risks and ensures peace of mind.

Strong Track Record

Our success since 2012 has resulted in repeat investments from clients.

Robust Risk Mitigation

Conservative strategies and diversification safeguard investments.

Scalability

We invest in large-scale real estate projects with higher potential returns.

People First

We prioritize people over bureaucracy - investors, clients and employees, always come first.

Transparent Reporting

Our quarterly updates keeps investors informed about investment's performance.

Best-in-Class Partnerships

We collaborate with leading developers and operating partners for successful project execution.

Ready to Take the Next Step?

The class starts on June 5th.

Reserve your spot now and gain the tools you need to confidently recommend smarter investments for your clients.

Frequently Asked Questions

Do I have to attend the class live to earn CE credit, or can I watch the recording?

You can only earn CE credit by attending the live class session.

When is the class, and how long is it?

The class is scheduled for December 18th, from 10:00 AM to 12:00 PM (CST). The class is two hours long and will be delivered via a live class session. It includes a step-by-step framework for evaluating private investments, with time for Q&A at the end.

How do I know this is a CFP® Board-approved CE course?

This course is currently approved by the CFP® Board. It offers valuable insights into evaluating private investments, and fulfill the CFP® Board's continuing education requirements at the intermediate course level. To ensure your CE credits are recognized, please refer to the CFP® Board's official website to see our class listed among approved providers and courses.

Is this class suitable for both newer and more experienced advisors?

Yes, this class is designed to benefit both newer and seasoned advisors. Whether you're just starting to evaluate private investments or looking to refine your existing processes, the framework will provide actionable insights that are applicable to all experience levels.

Will I be able to ask questions during the class?

Yes, there will be time at the end of the class for a live Q&A session where you can ask specific questions related to your practice and the material covered.

Carpathian Capital Management debuted on the Inc. 5000 list of America's fastest growing companies in 2022. Privacy Policy